Episode #38: The Secret To Building Wealth With The Least Effort

The easiest way to build long term wealth with as little effort as possible is to start saving and investing small amounts of money today, and letting compound interest grow your money for you. This is a well tried and tested method of growing wealth over the course of your life that you’ll find outlined in countless finance books from the wealthy barber, to the simple path to wealth, to the automatic millionaire. It’s the best way to get your money working for you with very little effort and input from you other than commitment and consistency. It’s the lazy person’s way to build wealth AND statistics show that by taking this route to grow your fortune, you’ll do better than the average day trader who spends all day every day starting at stock market stats, which just sounds like a win win to me! Over the course of your life this method will start to turn your dollars into millions, and I’ll explain how this works in this episode. First though there are three rules you need to remember if you want this wealth building method to work well for you.

Starting young is best so you can give your money more time to compound. When it comes to when you should start, as the old saying goes, the best time to plant a tree was 10 year ago, the second best time is today. Don’t keep waiting and wishing you’d started sooner.

You need to allow compound interest to work for you by using the stock market. This means staying invested safely in the stock market using long term buy and hold strategies and buying things like index funds that won’t leave you belly up.

And third, saving and investing as much money as you can will mean you retire more comfortably and with a larger amount of money. This means making the choice to live well within your means and save and invest the rest.

Now, if you don’t know what and of this means, don’t worry I’m going to explain everything in more detail, and I will walk you through each of the three rules. To start though, I want to make sure you understand what compound interest is.

What is compound interest?

The definition of compound interest is: the interest on a loan or deposit calculated based on both the initial principal and the accumulated interest from previous periods.

If this sounds like a load of gibberish to you that’s completely fair. This definition is not exactly helpful to anyone just getting started on improving their financial literacy. What it means is when you put money into an account you’ll earn interest on that money. Then the interest that you earned is added to the initial amount of money you started with so you have a greater amount of money. Then the interest is calculated again on that new larger sum of money, so you earn more interest. That interest is also added to the money you started with, and this just keeps going. It means you’re earning interest on the money you initially deposited, and you’re soon earning interest on top of interest on top of interest, so that if you never touch that account again, that money will grow without you ever having to do anything with it.

Rule number 1 is to start saving and investing when you’re young.

The best way to start building wealth over the course of your life is to start saving and investing while you’re young. This is because the magic ingredient that helps compound interest work, is time. The more time you have for your interest to compound, the larger and larger your principal amount will grow, and THIS is how people end up with millions of dollars of retirement savings, even if they never earned millions of dollars in their working lives.

The example in the graphic below demonstrates how just time affects compound interest in a retirement investment account so you can understand the difference of starting young and giving yourself time.

Rule number 2 is to maximize your interest earned by investing in the stock market.

I first defined compound interest for you based on the example of earning interest in a bank account, and while this is true you can earn compound interest from bank account interest rates, the interest rates available today aren’t anywhere near high enough for you to gain any major growth from it. So we use the stock market instead to achieve better growth with our money. The first rule I taught you was that time is the magic ingredient for compound interest to work well for you. The second ingredient you need to add to this recipe for success is a good rate of return. This is why you need to be investing to work on growing the money that you’ve saved. Just putting your savings into a bank account and letting it sit for the next 30 years will do nothing. Your money will barely grow if at all and it certainly won’t keep up with inflation which means that when it’s time for you to withdraw your money to pay for your retirement you will end up with less money than you started with and you certainly won’t have built any wealth.

If you’re a bit confused I’m going to show you another example. Let’s look back at Suzie and her friend Maggie. The example outlined in the graphic below will demonstrate how earning a higher interest rate will maximize your financial growth.

Rule #3 is that you will passively build more wealth by saving and investing more money.

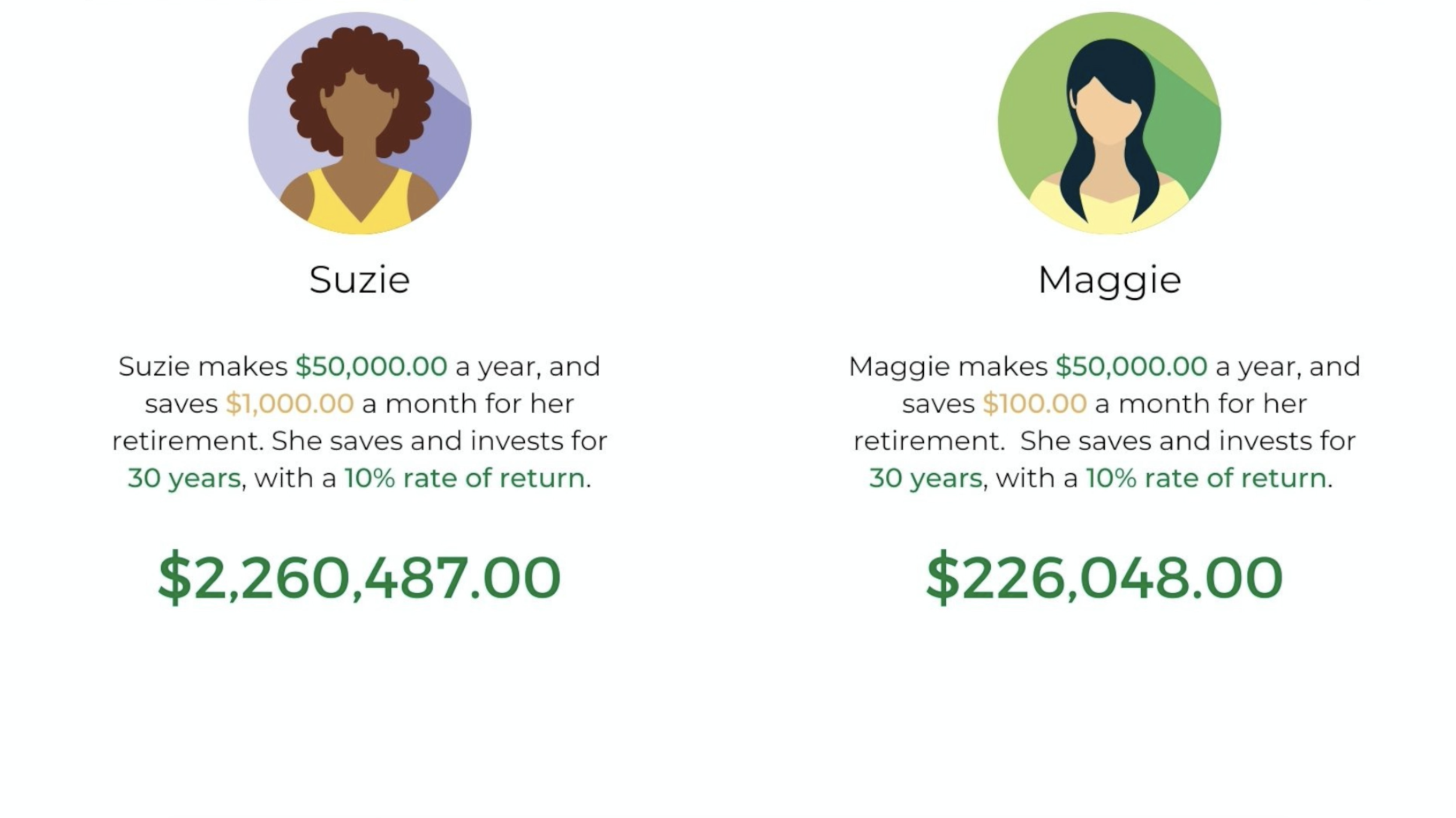

This final rule is relatively straightforward to understand, but not as easy to put into practice. It means that the more money you decide to save and invest, the more wealth you’ll build over time. It sounds pretty obvious but this is the hardest rule for people to embrace and use to their advantage because people want to spend money, so for this rule I’m going to show you two examples. I’m going to show you Suzie and Maggie compare when they save and invest different amounts of money over the course of their lives. The graphic below shows the difference between different savings levels.

Now, if you’re looking at this example and saying ‘that’s awesome but there’s no way I can save $1,000.00 a month’, I want to show you how a few small lifestyle adjustments that reduce your spending here and there can help you earn so much more. Let’s look at Netflix memberships for this example. Maggie’s life gets busy, so she decides to cancel her Netflix subscription of $10.00 a month, and add that money to her savings and investing account. The graphic below demonstrates the difference of Maggie saving just $10.00 more per month.

The idea here is not to shame your daily purchases, but to point out that if you’re serious about growing and building wealth passively so that you can retire comfortably or even just decide to up and retire early, then it’s well worth starting small with what you have, and then over time working on increasing the amount of salary that you can save. Even if you can only start by saving a few dollars each month, once you get into the habit of doing this then you can work to increase your savings rate, and eventually end up with a healthy retirement account to live on comfortably.

So, to recap all of this, the secret to building wealth with the least effort is to use the power of compound interest to grow that money for you. And there are three rules to understand and follow to maximize your passive wealth growth.

Give your money as much time to compound as possible. This mean starting when you’re as young as possible and following the adage the best time to plant a tree is today.

Maximize your rate of return by investing your money in the stock market. The are ways to do this safely, for example investing in ETF’s. Compound interest does nothing for you if you’re not earning enough ‘interest’ in the first place. Keeping that money in a savings account will get you nowhere.

Make lifestyle choices that allow you to save and invest as much as possible. While time is the magic ingredient, and rate of return is pretty darn important to the recipe, you can’t take full advantage of either of these if you’re not saving and investing enough in the first place. If saving is hard for you, start small, start saving and investing what you can, and make it your goal to increase the amount of money you can save over time.

Want to learn more? Check out the resources below!

Want to take the next step in your financial journey? Grab one of my free resources to start making moves with your money:

3-Day Personal Finance Challenge: Break up with broke and start building financial confidence https://howtoadultschool.com/personal-finance-challenge-download-page

First-Time Home Buyer’s Guide: Everything you need to know before buying your first home https://howtoadultschool.com/first-time-home-buyers-download-page

Expense Tracker: Finally feel in control of your spending with this easy-to-use tracker https://howtoadultschool.com/expense-tracker-download-page

My favourite personal finance tools:

Wealthsimple (High Interest Savings, Investing & TFSA/RRSPs): My favourite platform for personal banking AND investing wealthsimple.com/invite/OB9NB7

EQ Bank (High-Interest Savings Account): Another great option for high interest savings accounts (for Canadians) join.eqbank.ca/?code=CORYNN4617

Ready to get serious about mastering your finances?

Financial Foundations Course: Learn every personal finance skill we all *should* have been taught in school. https://howtoadultschool.com/financial-foundations-course

Investing Essentials Course: Learn to invest with confidence and grow your wealth https://howtoadultschool.com/investing-essentials-course

Group Coaching Subscription: Get expert guidance and support every month https://howtoadultschool.com/group-coaching-program

Some of the links above are either affiliate or referral links meaning I receive compensation from their use. By signing up using these links you can help support my work.