The Best High Interest Savings Accounts For Canadians (January 2026)

Hey friends,

After getting a little personal with you last week, I thought we’d keep things practical today and answer one of the questions that lands in my inbox constantly:

What are the best high interest savings accounts in Canada right now?

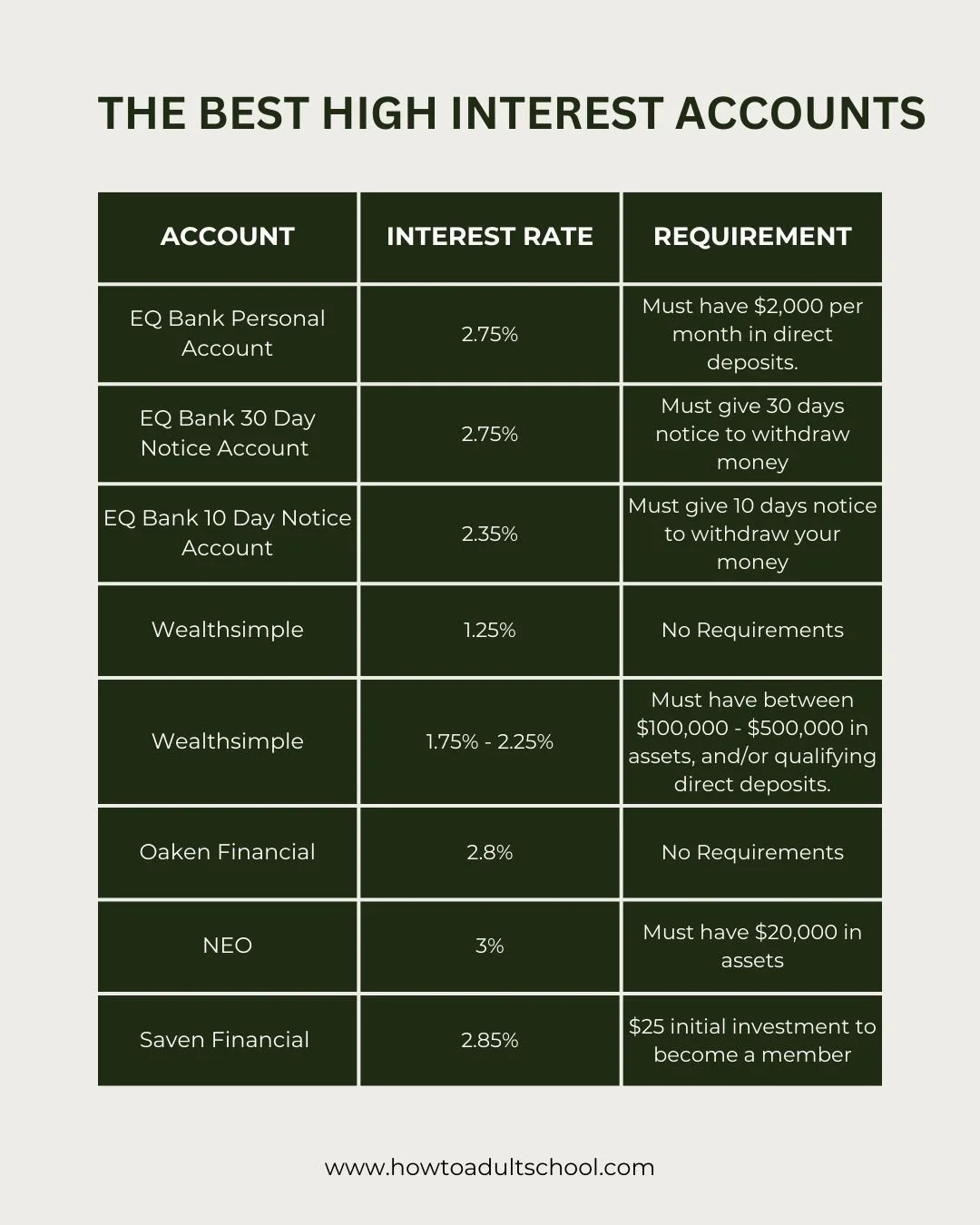

I’ve laid out a comparison table below with some solid options currently available. These are accounts with steady, ongoing interest rates. Not flashy promo offers that disappear the moment you get comfortable. If you want more context on why these accounts matter (and which one I personally use), keep reading after the table.

A quick note on promotional rates (aka: proceed with caution)

If you go digging on your own, you will absolutely find accounts advertising much higher interest rates. These are usually tied to ‘limited time promotions’. Personally? I don’t bother with these.

Promotional rates often come with fine print, minimum balances, withdrawal rules, or an expiry date that quietly drops you back to a mediocre rate later. At the end of the day, moving from one promotional offer to the next every 3 months is a lot of hoop-jumping for very little long term benefit. I would much rather see you:

Pick a solid, boring, consistently competitive option

Set it up once

Get on with your life

Remember, the financial systems you create should support you, not turn into a part time job to manage.

A refresher on high interest savings accounts

I recommend using high interest savings accounts as a home for money that needs to remain in cash. Most notably this means your emergency fund, but can also include any short term savings you have a clear reason not to invest yet. These accounts aren’t designed to grow your wealth in the long term, and they’re not a substitute for investing. BUT they do serve an important purpose by allowing your cash to at least earn something while it waits.

Most traditional savings accounts pay interest rates so low they’re almost invisible to the naked eye. There’s no need to allow your cash to sit completely idle, losing purchasing power to inflation every day. Most high interest accounts won’t completely override the effects of inflation, but they at least soften the blow. Think of these accounts as a practical middle ground, they’re not exciting, but they’re genuinely useful.

$20,000.00 earning 2.5% interest = $500.00 a year

$20,000.00 earning 0.05% interest = $10.00 a year

The ‘New Year’ nudge

The beginning of a new year is a great opportunity to turn the spotlight on your financial blind spots. If you don’t use a High Interest Savings Account, this is one of them.

If your emergency fund is still sitting in a chequing account, earning nothing, and parked at a traditional bank charging you monthly fees that seem to creep higher and higher every year, this is a simple opportunity to do better for almost no effort. Opening a proper high interest savings account is one of those quiet upgrades that reduces friction in your financial life almost immediately.

The start of the new year is exactly when these kind of low-effort, high-impact tasks are worth knocking off your list.

What I currently use (and why)

Over the years, I’ve moved my cash savings around fairly regularly, usually chasing the most competitive interest rate every year or two. Right now, I keep the majority of my financial assets with Wealthsimple.

They aren’t currently offering the highest interest rates on the market, but they’ve been consistently near the top for years, they don’t charge traditional banking fees, and their interest rate increases as your assets with them grow.

That said, assuming nothing changes, I'll likely be moving my emergency fund to NEO. I'll report back detailing my experience with them. :)

Promo codes

If you’re considering opening a high interest savings account or switching away from a traditional bank, I do have a Wealthsimple referral link, and an EQ bank referral link you can use. These give you a little bonus and support my work here at The How To Adult School. No pressure. Use it if it’s helpful. Ignore if it’s not.

Final housekeeping note

As always, please make sure you:

Read the terms and conditions yourself

Make sure you understand withdrawal rules and rate conditions

Double check that the account still fits your needs

Interest rates change, and many banks love adding a little chaos and confusion to your day. Stay mildly vigilant, but don’t let ‘research paralysis’ stop you from making a simple upgrade that genuinely improves your financial situation.

Sometimes progress just means moving your money somewhere less annoying.

See you next week,

-Cory